car sales tax wake county nc

Calculating North Carolina State Auto Sales Tax. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway.

Annexations Town Of Wake Forest Nc

Johnston Street Smithfield NC 27577 Collections Mailing Address.

. Wake Forest NC Sales Tax Rate. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. The Wake County Sales Tax is collected by the merchant on all qualifying.

Wake County Tax Administration The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. Physical Location 301 S. 3800 Raleigh NC 27601.

Many dealers offer cash incentives or manufacturer rebates on the sticker. A motor vehicle with a value of 8500. You can print a 725 sales tax table here.

Wake County Tax Administration. Johnston street smithfield nc 27577 collections mailing address. Box 2331 Raleigh NC 27602-2331 Please be certain to provide the mailing address to be used on your refund check.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. Within one year of surrendering the license plates the owner must present the following to the county tax office. This is the total of state and county sales tax rates.

These rates are weighted by population to compute an average local tax rate. The current total local sales tax rate in Wake Forest NC is 7250. The Wake County Sales Tax is collected by the.

The December 2020 total local. A motor vehicle with a value of 8500. A full list of these can be found below.

This refers to any rental vehicle that is offered at retail for short-term lease or rental and is owned or leased by an entity. 725 Is this data incorrect The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. This gross receipts tax is a substitute for the property tax on a short-term leased or rental vehicle.

The change was largely due to a 1 percent sales tax in Broward County and a 15. At the Wake County Public Health Center at 10 Sunnybrook Road in Raleigh. Sales Tax 30000 - 8000 03 Sales Tax 660.

The current total local sales tax rate in Wake County NC is 7250. Wake County sales tax. Box 2331 Raleigh NC 27602.

Sales and Use Tax Rates. To appeal the vehicles value see Appealing Value If the vehicle was registered in Wake County last year but has moved to a new taxing jurisdiction within Wake County that is not reflected on the notice. 800 am - 500 pm Monday - Friday.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. Contact the Wake County Department of Tax Administration.

WNCN The Wake County Public Health Department announced that it will host a walk-in monkeypox vaccination event this Saturday. Vehicles are also subject to property taxes which the NC. Wake Forest NC Sales Tax Rate.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. 025 lower than the maximum sales tax in NC. County rate 6195 Raleigh rate 3930 Combined Rate 10125 Recycling Fee 20.

Calculate North Carolina Sales Tax Example. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. The department said the walk-in event will be held on Saturday from 10 am.

The property is not located in a municipality but is in a Fire District. How are rebates and dealer incentives taxed. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

The December 2020 total local. Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration. North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275.

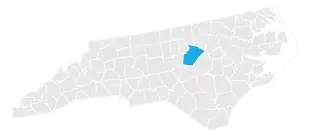

The monkeypox vaccination event is open. The average cumulative sales tax rate between all of them is 725. Wake County is located in North Carolina and contains around 14 cities towns and other locations.

Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward. The most populous location in Wake County North Carolina is Raleigh. Wake County Tax Administration PO.

North Carolina Department of Revenue. County rate 6195 Fire District rate 1027 Combined Rate 7222 No vehicle fee is charged if the property is not in a municipality. In North Carolina the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax.

Rocky Mount NC Sales Tax Rate. The department also collects gross receipts taxes. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Wake County NC Sales Tax Rate. Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees. Tax Administration Hours MondayFriday 830 am515 pm.

The Wake County Board of Commissioners implemented a 1½ gross receipts tax on rental vehicles effective July 1 2000. As for zip codes there are around 60 of them. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund.

For tax rates in other cities see North Carolina sales taxes by city and county. There is no applicable city tax.

Wake County Nc Property Tax Calculator Smartasset

Vehicles Town Of Wake Forest Nc

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

Wake County Covid Cases Wake Forest Raleigh Cary Holly Springs Wral Com

Watershed Education Town Of Wake Forest Nc

Homeowner Owners Could Be Pay More As Tax Hikes Are Proposed In Wake Raleigh Budgets Firefighters Rally For Pay Increase Abc11 Raleigh Durham

Wake Forest Map Town Of Wake Forest Nc

Historic Districts Town Of Wake Forest Nc

Flash Flood Warning Issued For Much Of Central Nc Including Wake Durham Counties Cbs 17

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake Forest Neighborhood Concerned Over Rash Of Car Break Ins Wral Com

Transportation Town Of Wake Forest Nc

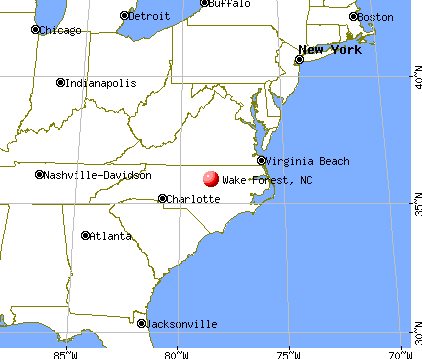

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake Commissioners Approve 1 7b 2023 Budget Including Tax Increase In Unanimous Vote Wral Com